News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Harvard Bought Bitcoin: The Smart Money Move During Market Dips Revealed

BitcoinWorld·2025/12/05 01:54

Crypto Fear & Greed Index Climbs to 28: Is the Market’s Fear Starting to Fade?

BitcoinWorld·2025/12/05 01:54

Aster Burns $80M in ASTER Tokens: A Bold Move to Boost Value

BitcoinWorld·2025/12/05 01:54

Crucial $3.4 Billion in Bitcoin Options Expire Today: What Traders Must Know

BitcoinWorld·2025/12/05 01:54

Altcoin Season Index Stalls at 23: Bitcoin’s Dominance Remains Unshaken

BitcoinWorld·2025/12/05 01:54

Stunning Confidence: Suspected Bitmine Wallet Buys a Massive $130.8M in Ethereum

BitcoinWorld·2025/12/05 01:54

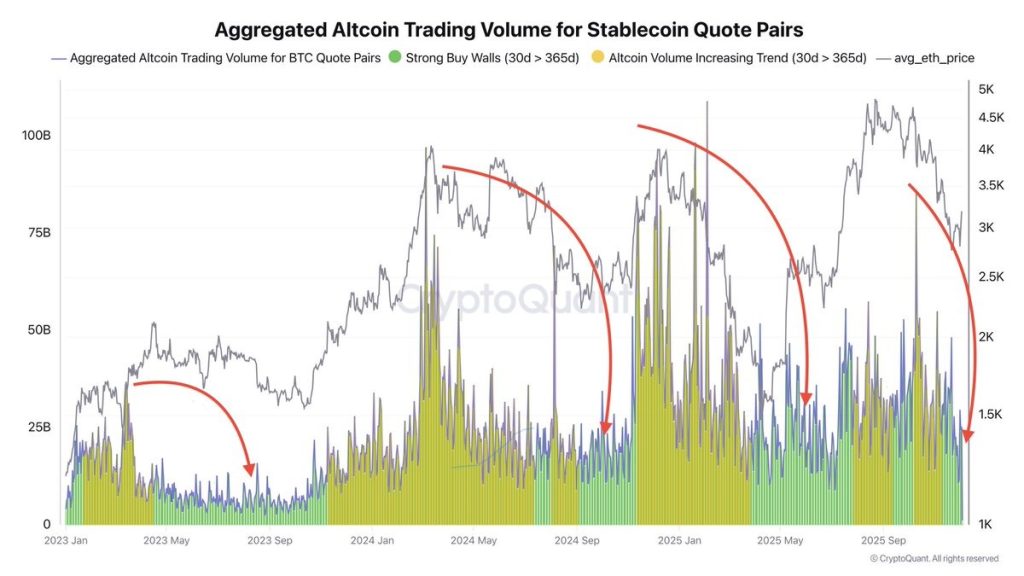

Altcoin Market Enters Historic Buying Zone — 5 Coins to Watch Before the Next Breakout

Coinpedia·2025/12/05 01:36

Crypto News: CZ Denies Trump Ties, But His Bitcoin Moment With Schiff Breaks the Internet

Coinpedia·2025/12/05 01:36

Russia to Include Crypto Payments in Balance-of-Payments Data

Coinpedia·2025/12/05 01:36

Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?

Cointelegraph·2025/12/04 22:09

Flash

16:05

Bitcoin falls below $87,000 as precious metal prices hit record highsIn early U.S. trading on Friday, major cryptocurrencies and related stocks generally declined, with bitcoin prices falling below $87,000 and bitcoin mining company stocks dropping more than 5%. Meanwhile, prices of precious metals such as gold, silver, platinum, and copper reached new highs, as geopolitical tensions drove capital flows into the precious metals market.

16:01

"simonbanza" made over $1.9 million in profits on Polymarket in two weeks, with a win rate of approximately 59%.BlockBeats News, on December 26, according to monitoring by lookonchain, trader simonbanza made over $1.9 million in profits on Polymarket in just two weeks. He closed a total of 108 bets, with 64 wins, achieving a win rate of approximately 59%. Most of his profits came from accurately betting on the outcomes of sports events.

16:01

Data: 5.371 million WLD transferred from VestingWallet, worth approximately $2.6157 millionChainCatcher News, according to Arkham data, at 23:57, 5.371 million WLD (worth approximately $2.6157 million) were transferred from VestingWallet to an anonymous address (starting with 0x64B9...).

News