News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

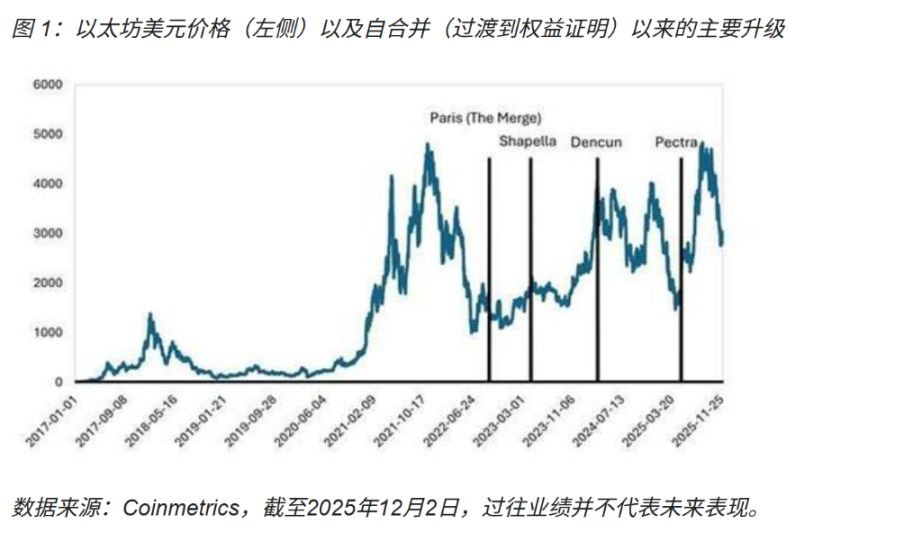

Ethereum undergoes "Fusaka upgrade" to continue "scaling and improving efficiency," strengthening on-chain settlement capabilities

The Fusaka upgrade will consolidate its position as a settlement layer and drive Layer-2 competition towards improvements in user experience and ecosystem depth.

深潮·2025/12/04 18:35

Space Review|Inflation Rebounds vs Market Bets on Rate Cuts: How to Maintain a Prudent Crypto Asset Allocation Amid Macroeconomic Volatility?

In the face of macro volatility, the TRON ecosystem offers a balanced asset allocation model through stablecoin settlements, yield-generating assets, and innovative businesses.

深潮·2025/12/04 18:35

Polymarket Opens Waitlist Access as US Relaunch Gains Momentum

Cointribune·2025/12/04 18:12

BitMine invests $150M in Ether and aims to control 5% of all Ethereum

Cointribune·2025/12/04 18:12

Crypto M&A Activity Soars in 2025, Surpassing $8.6 Billion

Cointribune·2025/12/04 18:12

Crypto: The SEC Slows Down 3x–5x Leveraged ETFs

Cointribune·2025/12/04 18:12

XRP Spot ETF Achieves Stunning 13-Day Inflow Streak, Nears $1 Billion Milestone

BitcoinWorld·2025/12/04 18:09

SUI ETF Breakthrough: SEC Stuns Market with First-Ever 2x Leverage Approval

BitcoinWorld·2025/12/04 18:09

Bitcoin Price Plummets: Key Reasons Why BTC Fell Below $92,000

BitcoinWorld·2025/12/04 18:09

Flash

18:27

The Federal Reserve reverse repo operation accepted $20.339 billionThe Federal Reserve accepted $2.0339 billion from 16 counterparties in its fixed-rate reverse repurchase operations.

17:34

Data: 31.4049 million SKY transferred from an anonymous address, worth approximately $2.1 millionAccording to ChainCatcher, Arkham data shows that at 01:25, 31.4049 million SKY (worth approximately $2.1 million) were transferred from an anonymous address (starting with 0xaae3...) to another anonymous address (starting with 0x2F86...).

17:34

The intraday gain of USD/JPY has expanded to 0.5%, now quoted at 156.66.ChainCatcher News, according to Golden Ten Data, the intraday gain of USD/JPY has expanded to 0.5%, now quoted at 156.66.

News