News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Revolutionary: MoneyGram’s New Stablecoin Payments System with Fireblocks Changes Everything

BitcoinWorld·2025/12/04 18:09

BTC Price Soars: Bitcoin’s Stunning Rally Breaks $93,000 Barrier

BitcoinWorld·2025/12/04 18:09

Metaverse Budget Shock: Meta Considers Slashing 30% from Reality Labs

BitcoinWorld·2025/12/04 18:09

Bitcoin Price Plummets: BTC Falls Below $92,000 in Market Shakeup

BitcoinWorld·2025/12/04 18:09

Ripple CEO Projects Bitcoin Could Reach $180,000 by End of 2026

DeFi Planet·2025/12/04 18:03

Solana Mobile Launches SKR Token to Power Seeker Ecosystem Security

DeFi Planet·2025/12/04 18:03

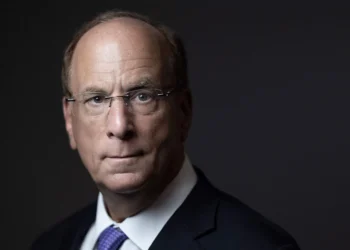

BlackRock’s Larry Fink Admits Bitcoin Misjudgment, Cites $70B ETF Success as Proof

DeFi Planet·2025/12/04 18:03

Ethereum Fusaka Upgrade Goes Live, Boosting Scalability Toward Instant Transactions

DeFi Planet·2025/12/04 18:03

Fanatics Launches Fanatics Markets, Boosting Crypto Prediction Access Nationwide

DeFi Planet·2025/12/04 18:03

Charles Schwab Eyes $12 Trillion Institutional Base with New Crypto ETF Push

DeFi Planet·2025/12/04 18:03

Flash

16:05

Bitcoin falls below $87,000 as precious metal prices hit record highsIn early U.S. trading on Friday, major cryptocurrencies and related stocks generally declined, with bitcoin prices falling below $87,000 and bitcoin mining company stocks dropping more than 5%. Meanwhile, prices of precious metals such as gold, silver, platinum, and copper reached new highs, as geopolitical tensions drove capital flows into the precious metals market.

16:01

"simonbanza" made over $1.9 million in profits on Polymarket in two weeks, with a win rate of approximately 59%.BlockBeats News, on December 26, according to monitoring by lookonchain, trader simonbanza made over $1.9 million in profits on Polymarket in just two weeks. He closed a total of 108 bets, with 64 wins, achieving a win rate of approximately 59%. Most of his profits came from accurately betting on the outcomes of sports events.

16:01

Data: 5.371 million WLD transferred from VestingWallet, worth approximately $2.6157 millionChainCatcher News, according to Arkham data, at 23:57, 5.371 million WLD (worth approximately $2.6157 million) were transferred from VestingWallet to an anonymous address (starting with 0x64B9...).

News