News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Dramatic Escape: How a Whale Avoided ETH Liquidation by a Mere $28

BitcoinWorld·2025/12/04 09:45

Revealed: Trump Family DeFi Project Makes Stunning $40.1 Million Move to Jump Crypto

BitcoinWorld·2025/12/04 09:45

Crucial Defense: Vitalik Buterin’s 3 Key Updates to Minimize Ethereum Attack Vectors

BitcoinWorld·2025/12/04 09:45

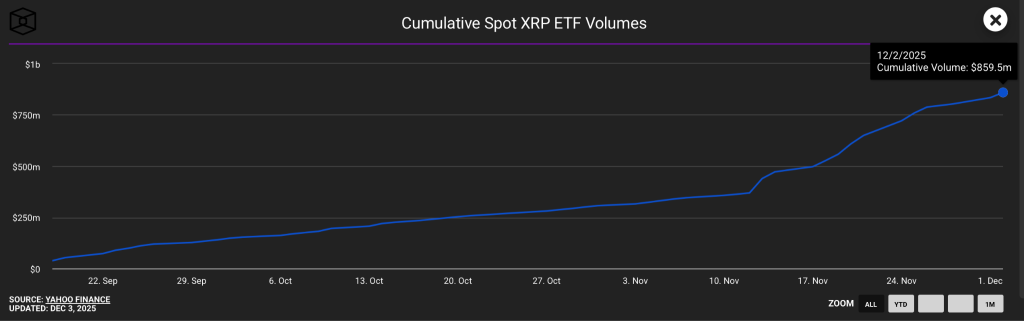

XRP ETF Flows Hit Record High—What It Means for XRP Price

Coinpedia·2025/12/04 09:15

Ethereum Hits New All-Time High for TPS Ahead of Fusaka Upgrade

Coinpedia·2025/12/04 09:15

Pi Network News: Expert Says ‘Sleeping Giant’ Fails to Wake As Stalled Protocol 23 Raises Doubts

Coinpedia·2025/12/04 09:15

Trump's CFTC, FDIC Picks Closer to Taking Over Agencies as They Advance in Senate

Cointime·2025/12/04 08:42

Glassnode: Is Bitcoin Showing Signs of 2022 Pre-crash? Watch Out for a Key Range

The current Bitcoin market structure closely resembles that of Q1 2022, with over 25% of on-chain supply in a state of unrealized losses. ETF fund flows and on-chain momentum are weakening, with price relying on a key cost basis area.

BlockBeats·2025/12/04 08:33

Flash

18:27

The Federal Reserve reverse repo operation accepted $20.339 billionThe Federal Reserve accepted $2.0339 billion from 16 counterparties in its fixed-rate reverse repurchase operations.

17:34

Data: 31.4049 million SKY transferred from an anonymous address, worth approximately $2.1 millionAccording to ChainCatcher, Arkham data shows that at 01:25, 31.4049 million SKY (worth approximately $2.1 million) were transferred from an anonymous address (starting with 0xaae3...) to another anonymous address (starting with 0x2F86...).

17:34

The intraday gain of USD/JPY has expanded to 0.5%, now quoted at 156.66.ChainCatcher News, according to Golden Ten Data, the intraday gain of USD/JPY has expanded to 0.5%, now quoted at 156.66.

News