News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

BlackRock's crypto ETF fee revenue fell by 38%, indicating that the ETF business is not immune to market cycles.

Bitcoin has dominated the market in this cycle, attracting over $732 billions in new capital. Institutional participation and market structure have significantly strengthened, while tokenized assets and decentralized derivatives are rapidly reshaping the industry ecosystem.

What are the new features in Clanker's presale?

Quick Take Solana treasury Solmate and veteran crypto venture and infrastructure firm RockawayX announced plans for an all-stock merger expected to close early next year. Solmate previously announced plans for an aggressive M&A strategy to bolster its treasury and staking operations.

Quick Take The IMF warned Thursday that stablecoins could speed up currency substitution in countries with weak monetary systems, reducing central banks’ control over capital flows. The IMF said the rise of dollar-backed stablecoins and their easy cross-border use may push people and businesses in unstable economies to favor dollar stablecoins over local currencies.

Quick Take On Thursday, executives from the likes of Citadel Securities to Coinbase to Galaxy discussed tokenization at an SEC Investor Advisory Committee meeting. Thursday’s meeting comes a day after some tension arose among some crypto advocates against a letter submitted by Citadel Securities on Wednesday.

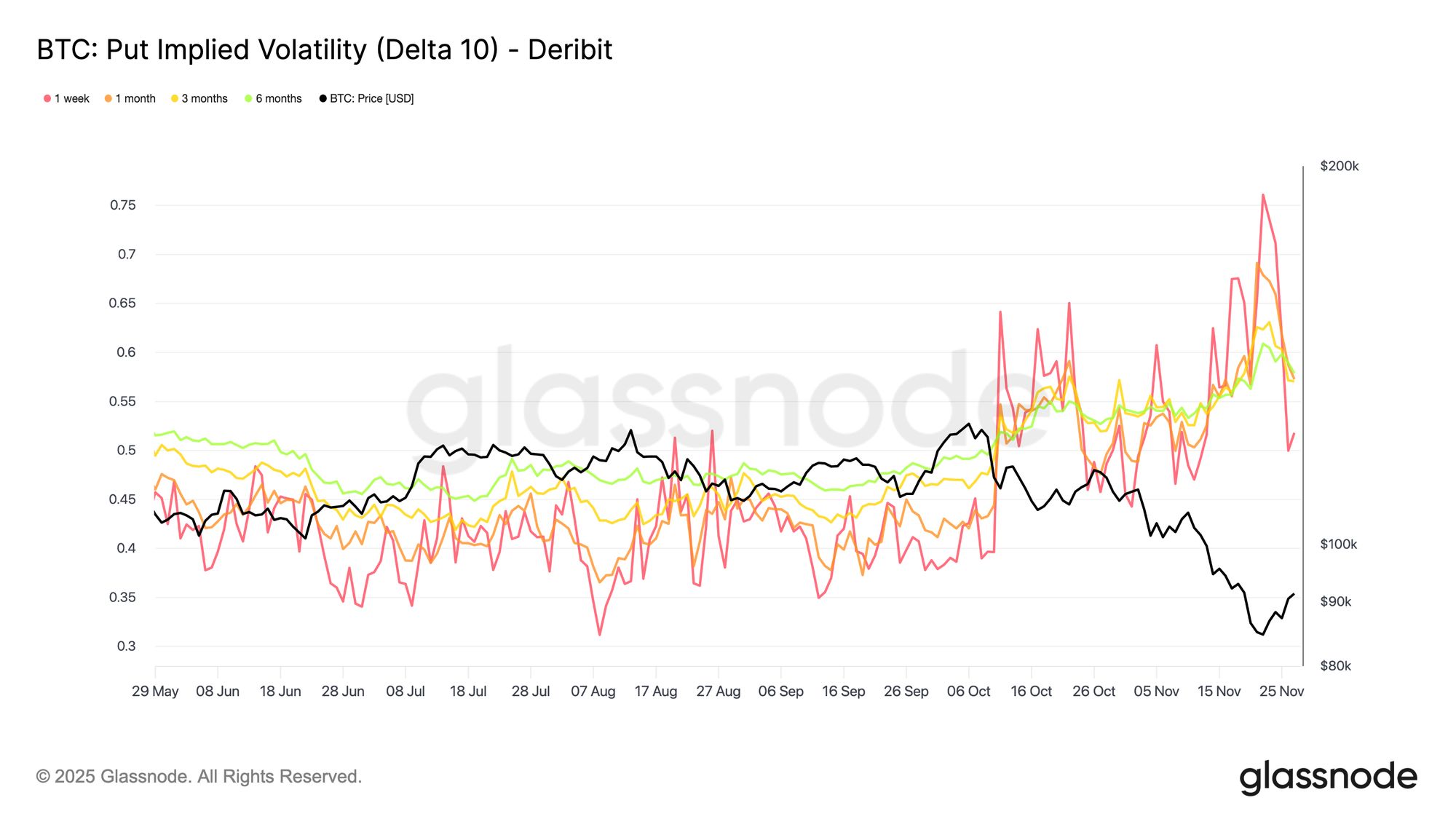

Interpolated implied volatilities across deltas and maturities for BTC, ETH, SOL, XRP, BNB, and PAXG are live in Studio, further expanding our options market coverage.