News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.29)|HYPE, SUI, and EIGEN tokens are set to undergo large unlocks this week; Bitcoin spot ETFs recorded a net outflow of $276 million in a single day, marking six consecutive days of net outflows2Bitget US Stock Daily Report | Spot Silver Continues to Surge, Refreshing 83 USD High; CME Raises Metal Performance Margins; US Stocks Focus on Fed Policy at Year-End (December 29, 2025)

AgentLISA tops the x402scan hot list, AI-driven smart contract security enters a period of rapid growth

AgentLISA's mission is to address this long-standing pain point in a real-time, scalable, and automated manner.

ForesightNews·2025/12/01 15:23

Bitcoin price slides to $85K: How low can BTC go in December?

Cointelegraph·2025/12/01 15:19

‘Inevitable’ $50K BTC price crash: 5 things to know in Bitcoin this week

Cointelegraph·2025/12/01 15:18

How Cardano plans to use $30M to bring real liquidity to the network

CryptoSlate·2025/12/01 15:00

Japan Ends Zero Interest Rate Policy: Risk Assets Face Their Worst Fear, the "Liquidity Turning Point"

From stocks and gold to Bitcoin, no asset can stand alone.

BlockBeats·2025/12/01 13:25

Prediction markets are coming to your brokerage

CryptoSlate·2025/12/01 12:00

After the Tide Recedes: Which Web3 Projects Are Still Making Money?

Most of them revolve around two things: trading and attention.

深潮·2025/12/01 11:46

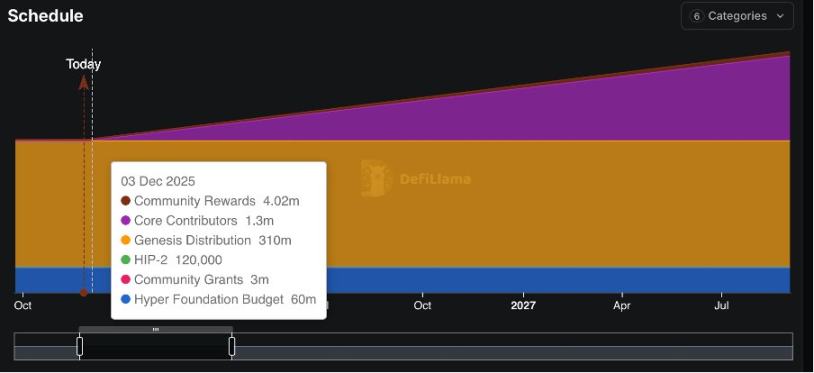

Why is HYPE not a good investment target right now?

Buybacks have always been a key mechanism supporting the price of HYPE; however, future token unlocks should not be overlooked.

深潮·2025/12/01 11:46

Looking at crypto Twitter, there is no longer a profit-making effect.

Looking at Crypto Twitter, there is no longer a profitable effect.

深潮·2025/12/01 11:46

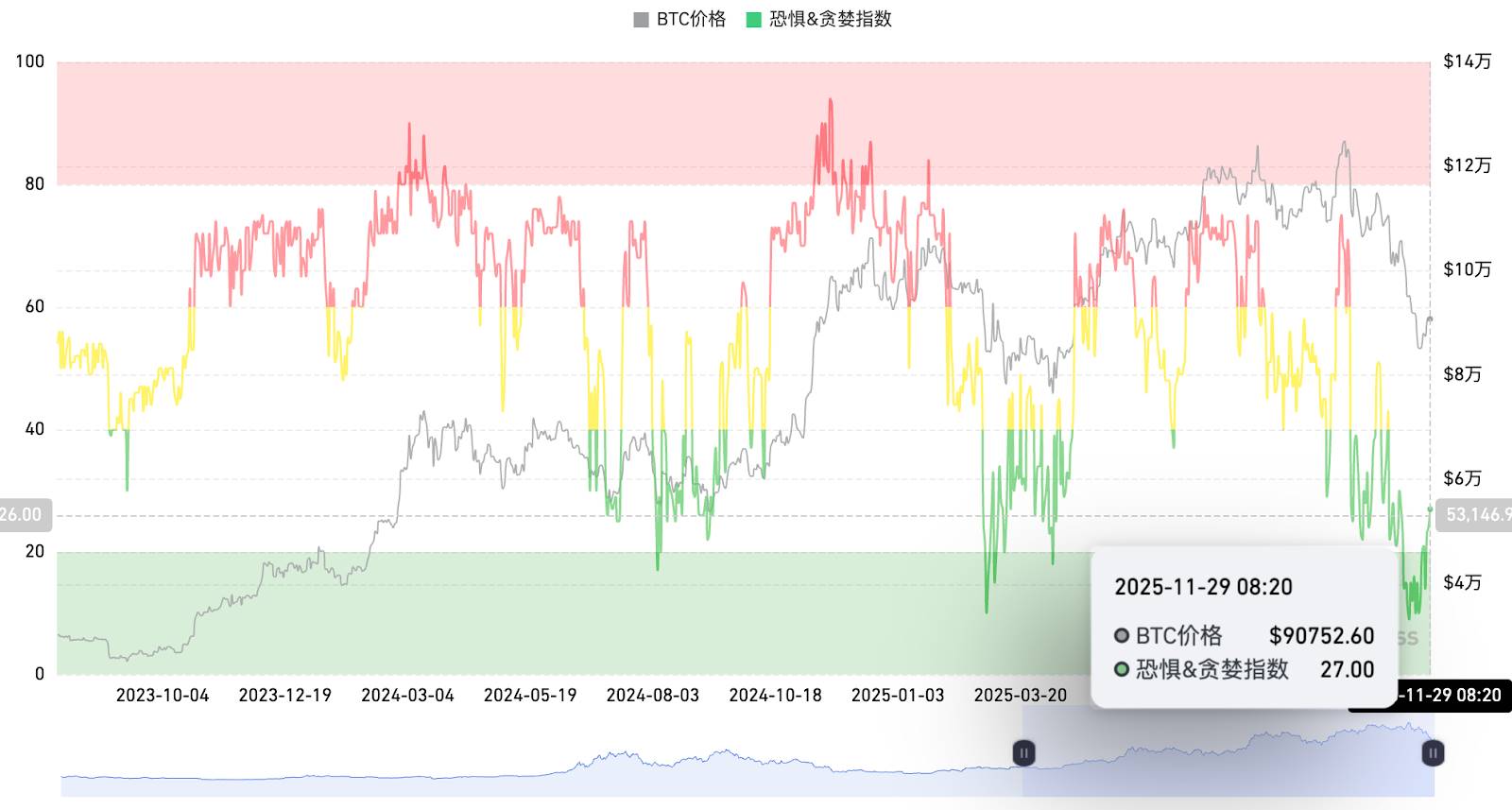

When the market falls into extreme fear, who is buying the dip against the trend?

For active traders: In the current volatile market, consider taking small long positions near support levels and reducing positions or considering short positions near resistance levels. Always set stop-loss orders for all trades.

深潮·2025/12/01 11:45

Flash

12:34

Trump "2.0" Challenges Fed's Independence, Wall Street on EdgeBlockBeats News, December 29th. As Trump ushers in the "2.0 era," the Fed is facing unprecedented political pressure. Trump has not only rarely appeared on the Fed's construction site to publicly dispute with Chairman Powell, but has also repeatedly criticized its monetary policy. He has even been reported to attempt to undermine Powell's influence through a "shadow chairman" mechanism, raising concerns in the market about the central bank's independence.

Reports point out that Trump has accused Powell of "politically motivated rate cuts" and has turned his criticism towards other members of the Federal Open Market Committee (FOMC), including attempting to push for the removal of Fed Governor Cook, with the related case set to go to trial in January next year. This move is seen as a significant challenge to the boundary between the White House and independent agencies.

Against this backdrop, there is a trend of "selective silence" within the Fed and among related personnel, emphasizing that policy is based solely on economic data to avoid further political conflict. Although analysts believe that the Fed's institutional independence and market oversight remain robust, successful high-level interference in personnel matters could once again put inflation expectations and market confidence under pressure.

Meanwhile, the White House is advancing the public selection process for the next Fed chair, causing market concerns that this will prematurely weaken Powell's authority and deepen internal divisions within the Fed. Wall Street generally believes that in the short term, policy uncertainty is rising, and the Fed's century-old independence is facing a severe test.

12:33

Trump criticizes the Federal Reserve and FOMC members, Cook denies accusations and appeals to the Supreme CourtTrump has publicly criticized Federal Reserve Chairman Powell and members of the Federal Open Market Committee (FOMC), referring to Powell as "Too Late Powell" and a "stubborn mule," among other remarks. He also attempted to accuse Federal Reserve Governor Cook of mortgage application fraud via social media. Cook denied the allegations and took the case to the Supreme Court, with hearings expected to begin in January next year.

12:30

Yihua's Trend Research Further Increases Holding of 6748 ETH, Total Position Now Shows Unrealized Loss of $117 MillionBlockBeats News, December 29, according to Ai Yi monitoring, 10 minutes ago, Easy Life's affiliated institution Trend Research once again withdrew $19.77 million worth of ETH from an exchange and then deposited it into Aave as collateral;

Over the past 7 hours, they have accumulated 27,598 ETH ($83.05 million), increasing on-chain holdings to 607,598 ETH, with a total value of $1.77 billion, an average cost of $3,111.07, and a total unrealized loss of $117 million.

News