News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Tech advocates vs price advocates: Monad's founder and Arthur Hayes have engaged in a remote debate.

Arthur Hayes questioned whether Tether's exposure to gold and bitcoin could pose insolvency risks, while Tether countered by highlighting its substantial equity. The debate between the two parties has reignited on X.

Monad’s FDV exceeded 4 billions the day after its launch?

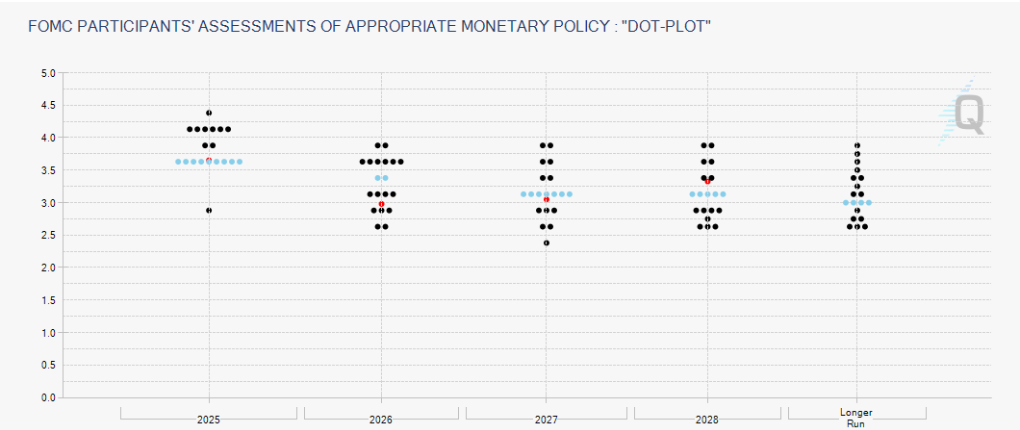

ETF determines the foundation of institutional support, while funding rates can amplify or weaken momentum. Stablecoins supplement native capital, and the structure of holders determines risk resilience. Macroeconomic liquidity controls the cost of capital.

Arthur Hayes has raised concerns about Tether's gold and Bitcoin exposure and the potential risk of insolvency. Tether has countered with significant proprietary equity, reigniting the debate between the two parties.

The darkest moments in human history often occur when the "offensive advantage" of technology outweighs its "defensive advantage." d/acc aims to reverse this imbalance.

Weekly highlights from December 1st to December 7th.