News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.15)|Bitget partners with World Cup champion Julián Álvarez to launch a promotional video; nearly 30% of Ethereum’s total supply is now locked in staking; FOGO will begin trading on the secondary market today2Bitget UEX Daily | White House Imposes 25% Chip Tariff; Trump Signs Rare Earth Security Order; Rare Earth Stocks Surge Against Trend;TSMC to Release Earnings (Jan 15, 2026)3$46B Flows Into ETF, But Bitcoin Struggles

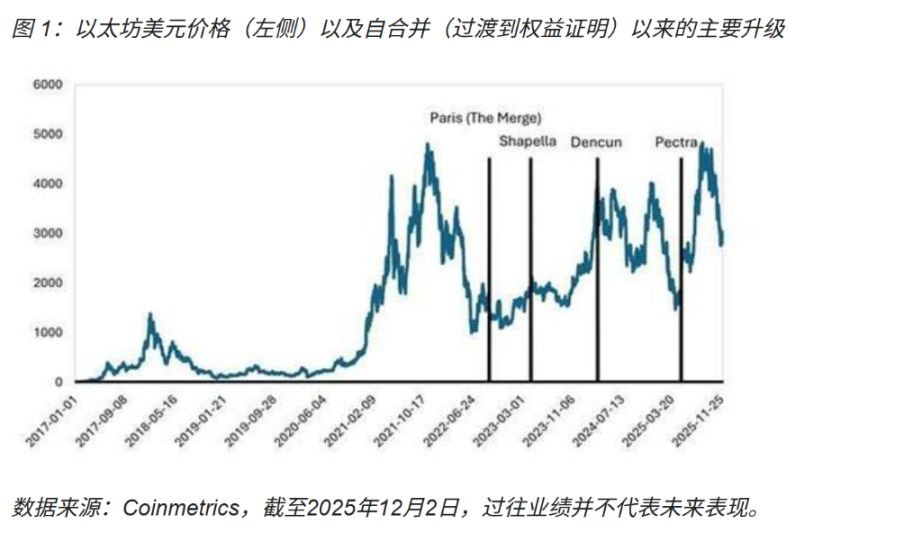

Ethereum undergoes "Fusaka upgrade" to continue "scaling and improving efficiency," strengthening on-chain settlement capabilities

The Fusaka upgrade will consolidate its position as a settlement layer and drive Layer-2 competition towards improvements in user experience and ecosystem depth.

深潮·2025/12/04 18:35

Space Review|Inflation Rebounds vs Market Bets on Rate Cuts: How to Maintain a Prudent Crypto Asset Allocation Amid Macroeconomic Volatility?

In the face of macro volatility, the TRON ecosystem offers a balanced asset allocation model through stablecoin settlements, yield-generating assets, and innovative businesses.

深潮·2025/12/04 18:35

Polymarket Opens Waitlist Access as US Relaunch Gains Momentum

Cointribune·2025/12/04 18:12

BitMine invests $150M in Ether and aims to control 5% of all Ethereum

Cointribune·2025/12/04 18:12

Crypto M&A Activity Soars in 2025, Surpassing $8.6 Billion

Cointribune·2025/12/04 18:12

Crypto: The SEC Slows Down 3x–5x Leveraged ETFs

Cointribune·2025/12/04 18:12

XRP Spot ETF Achieves Stunning 13-Day Inflow Streak, Nears $1 Billion Milestone

BitcoinWorld·2025/12/04 18:09

SUI ETF Breakthrough: SEC Stuns Market with First-Ever 2x Leverage Approval

BitcoinWorld·2025/12/04 18:09

Bitcoin Price Plummets: Key Reasons Why BTC Fell Below $92,000

BitcoinWorld·2025/12/04 18:09

Flash

11:40

David Sacks calls on the crypto industry to use the buffer period to resolve differencesDavid Sacks, the White House's head of cryptocurrency and artificial intelligence, stated that the likelihood of passing crypto asset market structure legislation is now near a historic high, and the crypto industry should use the current buffer period to resolve remaining differences. He emphasized that now is the best time to establish industry rules and safeguard future development. The White House will continue to work with Senate Banking Committee Chairman Scott, committee members, and industry stakeholders to promote the swift passage of bipartisan-supported legislation.

11:39

London Stock Exchange Group Launches 24/7 Blockchain Settlement Platform for Tokenized DepositsBlockBeats News, January 15, According to The Block, London Stock Exchange Group (LSEG) announced today the launch of the London Stock Exchange Group Digital Settlement House (LSEG DiSH), a platform designed to leverage blockchain technology for 24/7 real-time commercial bank tokenized deposits settlement. LSEG DiSH supports multi-currency and cross-network settlement, provides dynamic intraday liquidity management, synchronized settlement (PvP/DvP), and risk reduction capabilities, and is operated by the LSEG Post Trade Solutions division.

The platform can settle not only on its own ledger but also serve as a notary to support settlement on connected networks. Currently, LSEG has completed a proof of concept (PoC) on the Canton Network with software company Digital Asset and a consortium of financial institutions, successfully achieving same-day cross-currency and asset type repo transactions. Additionally, LSEG previously launched a blockchain platform for private funds in September 2025.

11:35

Tom Lee: Vitalik and Sam Altman to attend BitMine shareholders' meetingForesight News reported that BitMine Chairman Tom Lee stated in an interview with 3PROTV that Ethereum founder Vitalik Buterin and OpenAI CEO Sam Altman are expected to attend the annual shareholders' meeting held today (January 15). The meeting will vote on a proposal to increase the company's authorized shares from 500 million to 50 billion. Tom Lee emphasized that if the proposal is not approved, the company will not be able to issue new shares to purchase more Ethereum or make acquisitions. Addressing concerns about dilution, he stated that the company has never issued shares below net asset value. In addition, BitMine will present its 2026 development roadmap at the meeting, including growth sources beyond staking yields, and revealed that it may acquire other crypto treasury companies in the future.

News