News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low2Bitget US Stock Morning Brief | Fed Internal Divisions Widen; Trump Accelerates Space Militarization; Pharma Giants Accept Price Cuts for Tariff Relief (December 20, 2025)3Review of Major Institutions' Bitcoin Price Predictions for 2025: Almost All Failed

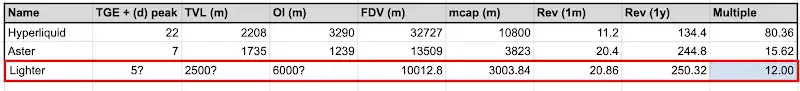

Opinion: Why Lighter Is Seriously Undervalued

BlockBeats·2025/12/17 09:39

Collably Network Partners with Flipflop to Revolutionize Fair Token Distribution

BlockchainReporter·2025/12/17 09:31

Bitcoin Exchange Netflow Signals Big Shift Ahead

UToday·2025/12/17 09:31

After Wasting Four Years, SEC Ends Yet Another Crypto Investigastion

UToday·2025/12/17 09:31

No Crystal Ball: VanEck Refuses to Release 2026 Crypto Predictions

UToday·2025/12/17 09:31

Flash

03:22

Aave community to launch ARFC proposal vote on "transfer of brand asset control to token holders" tomorrowForesight News reported that the Aave community will launch an ARFC proposal vote on Snapshot at 10:40 tomorrow (UTC+8) regarding the "transfer of brand asset control to token holders." The voting will continue until December 26. The proposal includes clearly defining the ownership, usage rights, and related terms of Aave's brand assets and intellectual property (such as domain names, social media accounts, naming rights, etc.), and granting the DAO governance authority over these assets.

02:52

Ray Dalio: Bitcoin is unlikely to be held in large amounts by central banks and many othersForesight News reported that Ray Dalio, founder of Bridgewater Associates, stated in a podcast that "bitcoin is a form of money with a limited supply and is regarded as a store of wealth. However, central banks and other institutions are unlikely to hold large amounts of bitcoin, mainly due to issues such as transaction traceability, the risk of government intervention, and technical risks (such as being hacked). I recommend holding 5-15% of gold or other alternative currencies in a personal investment portfolio as a diversification tool."

02:30

A major whale increases its short positions, with holdings valued at over $122 million.Foresight News reported, according to monitoring by Lookonchain, the whale who previously sold 255 BTC (approximately $21.77 million) to short BTC and ETH is currently increasing their short positions. Their current holdings include: 1,362.76 BTC (approximately $120 million) and 715.79 ETH (approximately $2.15 million).

News