News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low2Bitget US Stock Morning Brief | Fed Internal Divisions Widen; Trump Accelerates Space Militarization; Pharma Giants Accept Price Cuts for Tariff Relief (December 20, 2025)3Review of Major Institutions' Bitcoin Price Predictions for 2025: Almost All Failed

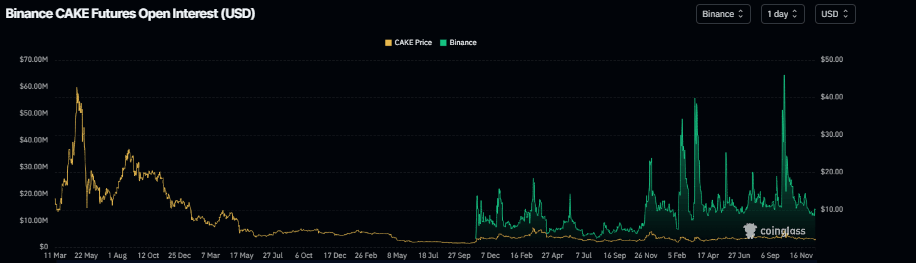

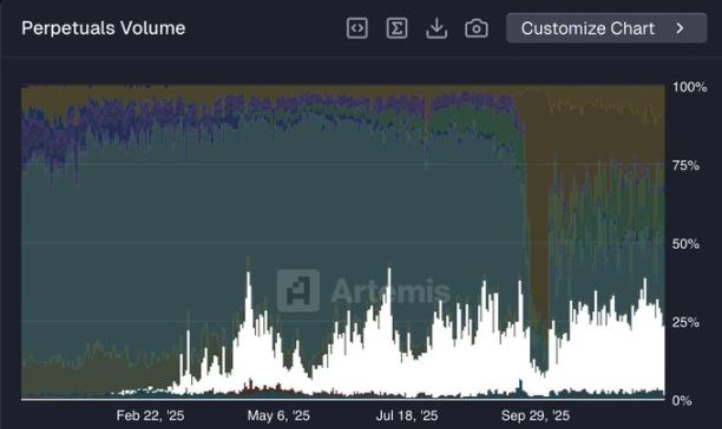

With its market share plummeting by 60%, can Hyperliquid make a comeback?

AIcoin·2025/12/17 09:13

Russia Rules Out Bitcoin Payments "Under Any Circumstances"

币界网·2025/12/17 09:05

Odaily Editorial Tea Talk (December 17)

Odaily星球日报·2025/12/17 09:04

Bitcoin Christmas Rally: By the end of 2025, will "Santa Claus" deliver gifts on time?

AIcoin·2025/12/17 09:02

EtherFi Joins ETHGas Marketplace to Enable Gasless Ethereum Transactions and Boost Validator Economics

BlockchainReporter·2025/12/17 09:00

Lark Davis says Chainlink is "much better" than XRP.

币界网·2025/12/17 08:50

Decentraland Price Prediction 2026-2030: Can MANA Finally Reach the Elusive $1 Milestone?

Bitcoinworld·2025/12/17 08:48

Flash

06:04

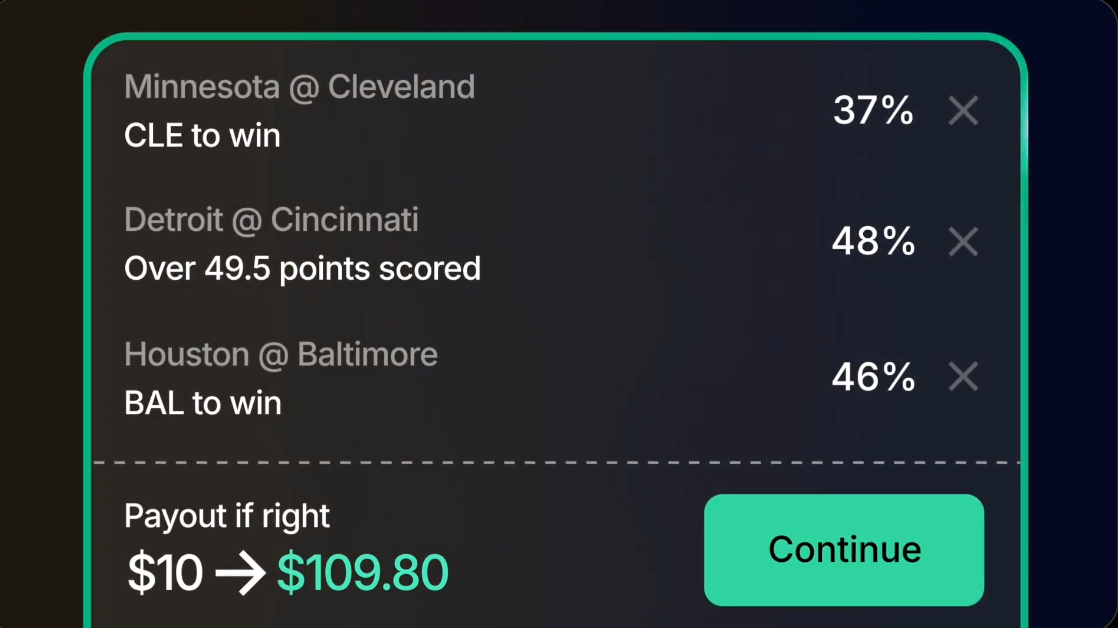

Polymarket predicts an 87% probability that Lighter's market cap will exceed 1 billion USD on the day after its listing.Foresight News reported that in the Polymarket prediction event "Lighter's Market Cap on the Day After Listing," the market bets that the probability of exceeding 1 billion USD is 87%, the probability of exceeding 2 billion USD is 84%, and the probability of exceeding 3 billion USD is 52%.

05:59

Data: Over 2 million PSOL have been minted on PhantomForesight News reported, according to official data, more than 2 million PSOL have been minted on the crypto wallet application Phantom.

05:31

HyperLiquid team: The short-selling address discovered by the community belongs to a former employee who has left the companyForesight News reported that a HyperLiquid team member posted on Discord, stating, "Regarding recent community inquiries about the short-selling address starting with 0x7ae4: this address belongs to a former employee who was dismissed in the first quarter of 2024. This individual is no longer associated with Hyperliquid Labs, and their actions do not represent the standards and values of our team."

News