News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Solana Sees Increased Long-Term Holder Accumulation Amid Price Decline and Support Test2Ethereum May Find Support Amid Multi-Level Moving Averages Despite Recent Price Correction3Bitcoin Nears $113,900 Resistance Amid CME Gap and Balanced Short-Term Sentiment

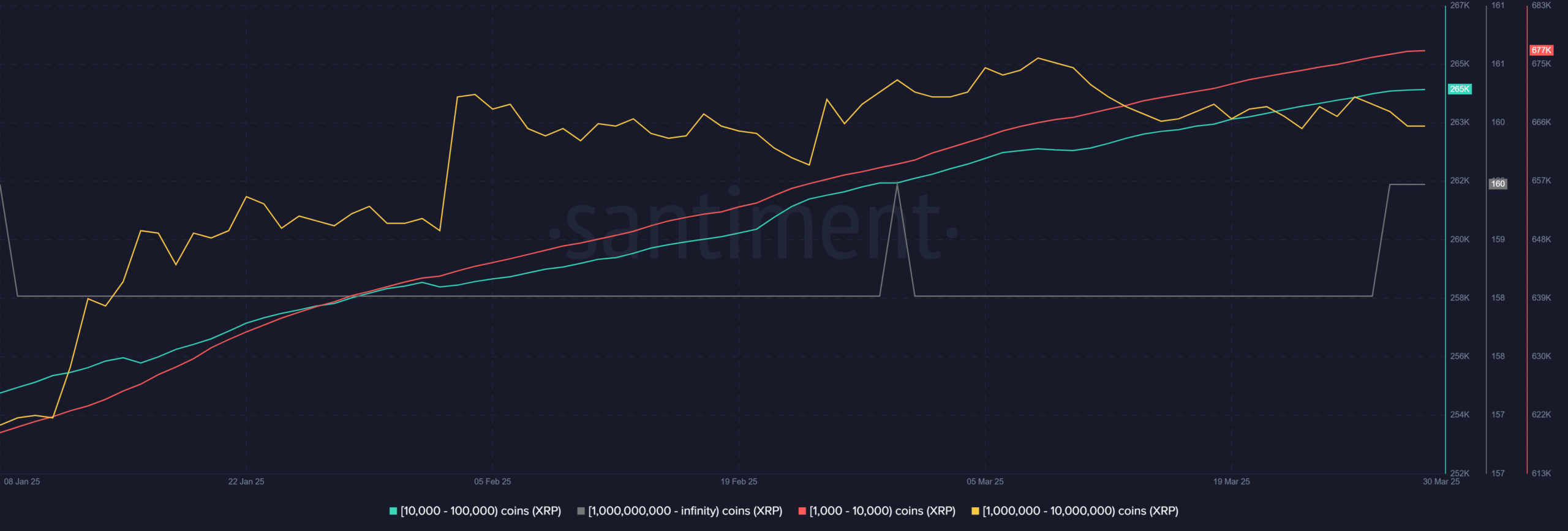

XRP’s Future: Analysts Suggest Possible Consolidation and Target of $12.50 Amid Market Uncertainty

Coinotag·2025/03/29 16:00

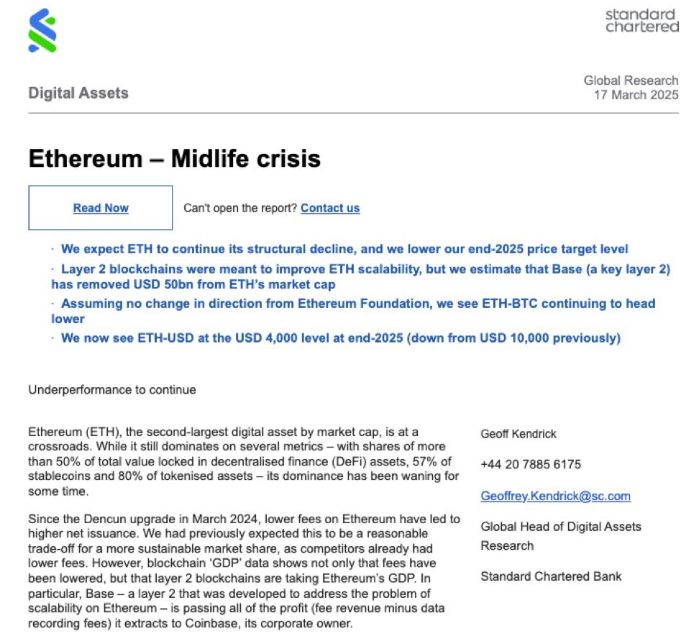

Ethereum’s Path Forward: Can the Pectra Upgrade Enhance Long-Term Utility Amid Market Challenges?

Coinotag·2025/03/29 16:00

Whale Sale Raises Questions About Solana’s Future Amid Robust Network Growth and Price Support

Coinotag·2025/03/29 16:00

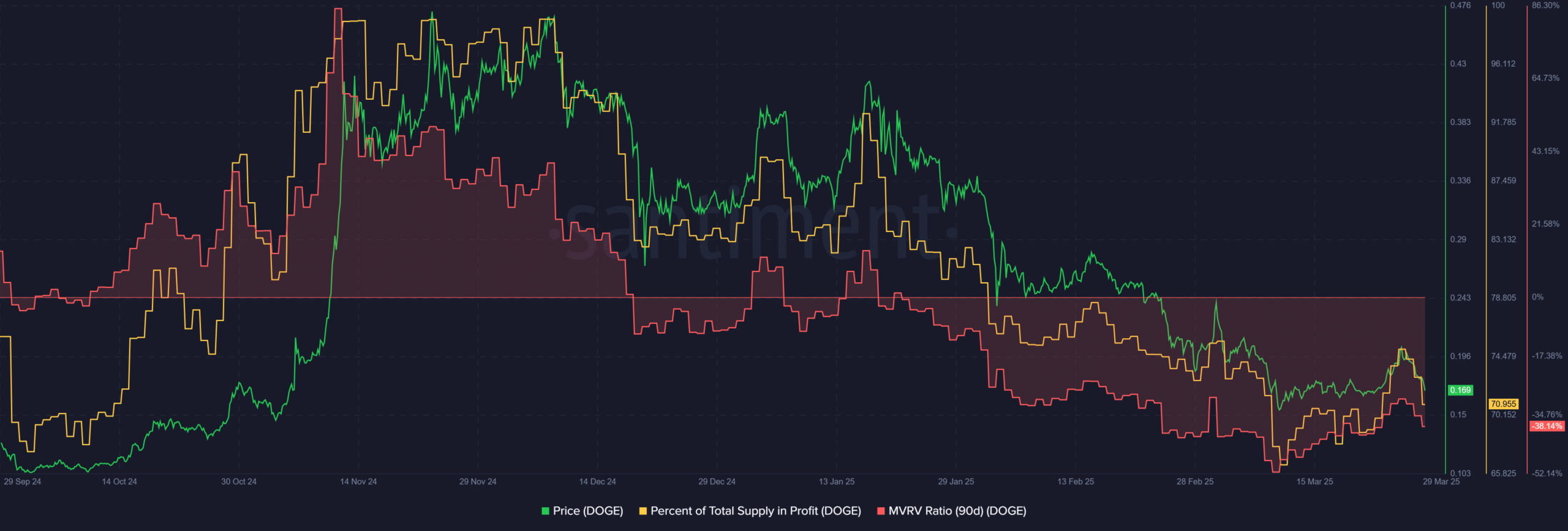

Dogecoin Bulls Eye Potential Support at $0.14 Amid Ongoing Market Weakness

Coinotag·2025/03/29 16:00

Hyperliquid (HYPE) Drops 2.06% as Whale Adds Margin to Avoid Liquidation

Newscrypto·2025/03/29 16:00

Uniswap’s app store ranking dives as user activity and trading volume decline

Quick Take Uniswap’s U.S. app store ranking surged after the pro-crypto election victory but has since collapsed from #99 to #364. The following is an excerpt from The Block’s Data and Insights newsletter.

The Block·2025/03/29 16:00

Analysis of $700k oracle manipulation exploit highlights vulnerabilities in DeFi vaults

Quick Take In February, an oracle manipulation attack affected DeFi protocols across Ethereum Layer 2 network ZKsync, including Venus Protocol, which suffered a $717,000 loss from taking on bad debt. The attacker manipulated the exchange rate of Mountain Protocol’s wUSDM wrapped yield-bearing stablecoin by using a flash loan and exploiting a donation-based vulnerability in standard ERC-4626 tokenized vaults.

The Block·2025/03/29 16:00

Pi Network Price Drops but Shows Signs of Recovery

Newscrypto·2025/03/29 16:00

Flash

- 01:12Suspected ETH reserve institution address accumulated another 15,846 ETH and staked them 7 hours ago, worth $55.34 millionAccording to Jinse Finance, on-chain analyst Yujin has monitored that an address likely belonging to an ETH reserve institution accumulated another 15,846 ETH (worth $55.34 million) and staked them seven hours ago. This institution has been accumulating ETH through the institutional trading platform mentioned below. Since August 1, they have accumulated a total of 41,452 ETH (worth $148 million) at an average price of approximately $3,575. After receiving the ETH, all of it was staked in PoS via Figment, which is quite similar to SharpLink Gaming (SharpLink (SBET) has also staked a significant portion of its ETH through Figment). This address may belong to SharpLink, but whether it does can be inferred when SharpLink next announces its ETH reserve holdings.

- 01:07"Insider Trader" qwatio Faces Partial Liquidation of Multiple Crypto Short Positions, Current Unrealized Profit Drops to $1.3 MillionAccording to Jinse Finance, Onchain Lens monitoring shows that the "insider trader" falllling (@qwatio) has had some of their short positions partially liquidated: 40x leverage on Bitcoin, 25x leverage on Ethereum, 20x leverage on SOL, and 20x leverage on XRP. The trader had an unrealized profit of $12 million the previous day, which has now dropped to $1.3 million.

- 00:58ANZ: Trump’s Dismissal of BLS Chief Undermines US Economic Safe-Haven StatusAccording to ChainCatcher, citing JIN10 News, the currency market has shown clear signs of unease following Trump's dismissal of U.S. Bureau of Labor Statistics Director McEntaffer, amid accusations of attempting to manipulate economic data. At the same time, the independence of the Federal Reserve is also facing ongoing attacks from the government. ANZ Bank stated in its report that financial markets place a high value on the independence of statistical data, and the dismissal of McEntaffer "can easily be seen as yet another move that undermines the United States' status as a global economic safe haven."