News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 24)|Ethereum achieves real-time L1 block proof; Solmate surges 40% after $300M financing; Stable’s $825M pre-deposit raises insider concerns2Bitcoin falls below $115,000—is this a delayed reaction to the sale of 80,000 BTC?3Research Report|In-Depth Analysis and Market Cap of aPriori (APR)

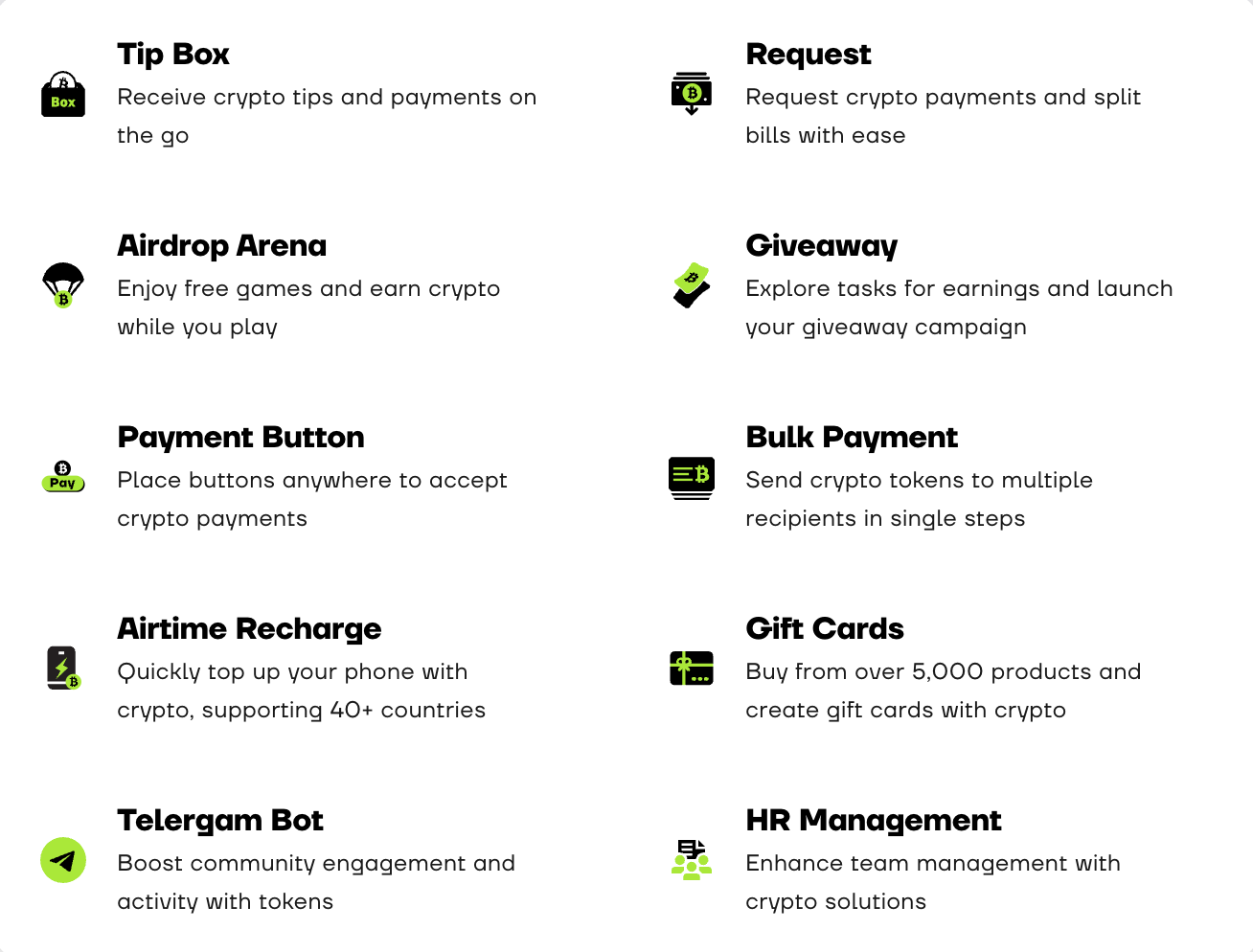

From Bot Wallet to All-in-One Financial Ecosystem: Cwallet 3.0 Evolution in Progress

深潮TechFlow·2025/10/24 16:19

Solana Saga loses software and security updates

CryptoValleyJournal·2025/10/24 16:18

Standard Chartered Forecasts Bullish Bitcoin Future Despite Trade Tensions

Theccpress·2025/10/24 15:09

BlackRock Acquires 1,884 Bitcoin for Its ETF

Theccpress·2025/10/24 15:09

Dogecoin price chart projects 25% gains, but first, this must happen

Cointelegraph·2025/10/24 14:36

AI gives retail investors a way out of the diversification trap

Cointelegraph·2025/10/24 14:36

Can Ethereum reclaim $4K? ‘Smart trader’ whale raises ETH long to $131M

Cointelegraph·2025/10/24 14:36

Western inscriptions debut? x402 gold rush floods into PING

PING currently has a market capitalization of over $30 million, with a 24-hour trading volume exceeding $20 million.

ForesightNews 速递·2025/10/24 14:32

Will MegaETH, with a pre-market value of 5 billions and using an English auction, deliver excess returns?

Polymarket predicts that there is an 89% chance that MEGA will have a trading price exceeding a $2 billions FDV within 24 hours of issuance, and a 50% chance of exceeding a $4 billions FDV.

ForesightNews 速递·2025/10/24 14:31

Ethereum Faces Heavy Selling | Long-Term Trend Still Bullish

TheCryptoUpdates·2025/10/24 13:33

Flash

- 16:17Data: In the past 24 hours, total liquidations across the network reached $260 millions, with long positions liquidated for $118 millions and short positions liquidated for $142 millions.ChainCatcher news, according to Coinglass data, in the past 24 hours, the total amount of liquidations across the network reached $260 million, with long positions liquidated for $118 million and short positions liquidated for $142 million. Among them, bitcoin long positions were liquidated for $23.1161 million, bitcoin short positions for $49.6468 million, ethereum long positions for $40.9671 million, and ethereum short positions for $36.1961 million. In addition, in the past 24 hours, a total of 109,859 people were liquidated globally, with the largest single liquidation occurring on a certain exchange - BTCUSD valued at $8 million.

- 16:06Tether CEO: Expected annual profit of $15 billion with a profit margin as high as 99%Jinse Finance reported that Tether CEO Paolo Ardoino recently stated in an interview at a forum in Switzerland that Tether's profit this year will approach $15 billions, with a profit margin as high as 99%. When asked about the type of investors he would like to attract, he said that many companies in the portfolios of funds and technology funds might use some of Tether's technologies and products, which is related to synergy and greater influence. However, he did not disclose information about potential investors.

- 16:06Bonk Holdings wallet received BONK tokens worth $32 million through FalconXOn October 24, according to monitoring by analyst Emmett Gallic, the Solana on-chain Squad multi-signature wallet of crypto treasury company Bonk Holdings Inc. received 2.26 trillion BONK (worth $32 million) via FalconX.