News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Exploring the differentiated ecosystem layout of Aptos in the new cycle and competitive landscape of public blockchains, as well as its future growth strategies under the core vision of becoming a "global trading engine."

The founder is smiling, while investors are panicking.

Power restructuring in probability games.

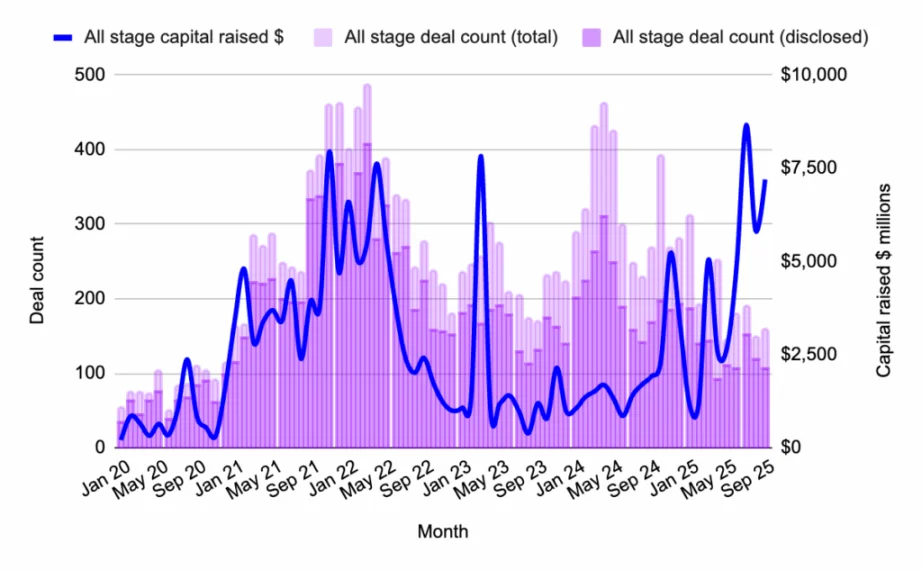

160 transactions raised $7.2 billions, marking the highest total since the spring surge.

See how BlockDAG’s Buyer Battles boost activity, Hyperliquid gains from U.S. listings, and Cardano holds firm before a potential breakout.Hyperliquid Price Climbs After Robinhood LaunchCardano Maintains Strength Near $0.54 SupportBlockDAG’s Buyer Battles Drive Global Demand!Last Say: Which One Is the Best Crypto Investment

- 07:22Semantic Layer completes $5 million Series A funding round, led by Greenfield CapitalChainCatcher news, Semantic Layer has completed a Series A funding round led by Greenfield Capital, with a total financing amount of 5 million US dollars, aiming to promote on-chain AI autonomy and agents, as well as the sovereignty of dApp and asset ranking. In addition, a certain exchange Alpha has listed Semantic Layer (42). Previously, MEV infrastructure developer Semantic Layer completed a 3 million US dollar seed round led by Figment Capital, which was used to develop core products and enhance the visibility of the ASS market, including sponsoring research and developer activities.

- 07:22Semantic Layer completes $2 million Series A financingJinse Finance reported that MEV infrastructure Semantic Layer has announced the completion of a $2 million Series A funding round, led by Greenfield Capital, bringing the total funding to $5 million. The aim is to advance on-chain AI autonomy and agency, as well as the sovereign ordering of dApps and assets.

- 07:06Matrixport: Bitcoin is at a critical inflection point, with long-term holders slowly transferring their holdings to a new generation of institutional buyersJinse Finance reported that Matrixport released its daily chart analysis, stating, "In several recent reports, we pointed out that bitcoin is approaching a critical threshold—a typical 'bull-bear dividing line' that has historically proven to be highly reliable. Multiple structural indicators are flashing warning signals: futures open interest relative to the 90-day moving average has started to decline, our trend model has turned bearish, and the price has fallen below the 21-week moving average—a level that has historically marked the watershed between 'continuing to go long' and a 'neutral' market state. On the surface, bitcoin appears calm. Price movement is stagnant, volatility is gradually fading, and most investors believe the current range is just 'normal consolidation.' However, this interpretation overlooks a deeper structural change: bitcoin is not quietly resting, but is instead undergoing a silent transfer of ownership—and this transfer is taking place within the most critical price range of this cycle. Beneath the calm surface, long-term holders are gradually distributing their chips to a new batch of institutional buyers, and this handover has created a rare sense of 'stillness.' In addition, bitcoin has already fallen below the short-term realized price, increasing liquidation risk. Individually, these are all warning signals; when they appear together, they constitute a clear risk warning."