News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.23)|Michael Selig Appointed as the 16th Chair of the CFTC; Powell Has Secured Three Rate Cuts; Strategy Adds $748M to Its Reserves2Bitget US Stock Daily Report | Gold Breaks $4,460; Tesla Approaches $500; Novo Nordisk Oral Drug Approved (December 23, 2025)3Bridgewater founder: Enormous risks from huge bubbles and vast wealth gaps

Netflix responds to concerns about WBD deal

TechCrunch·2025/12/15 16:39

Bitcoin (BTC) Price Plummets – What’s the Latest? il Capo Calls It a “Bear Trap” and Explains What to Expect

BitcoinSistemi·2025/12/15 16:36

Critical Alert: New York Fed’s Williams Declares Inflation Remains Dangerously High

Bitcoinworld·2025/12/15 16:27

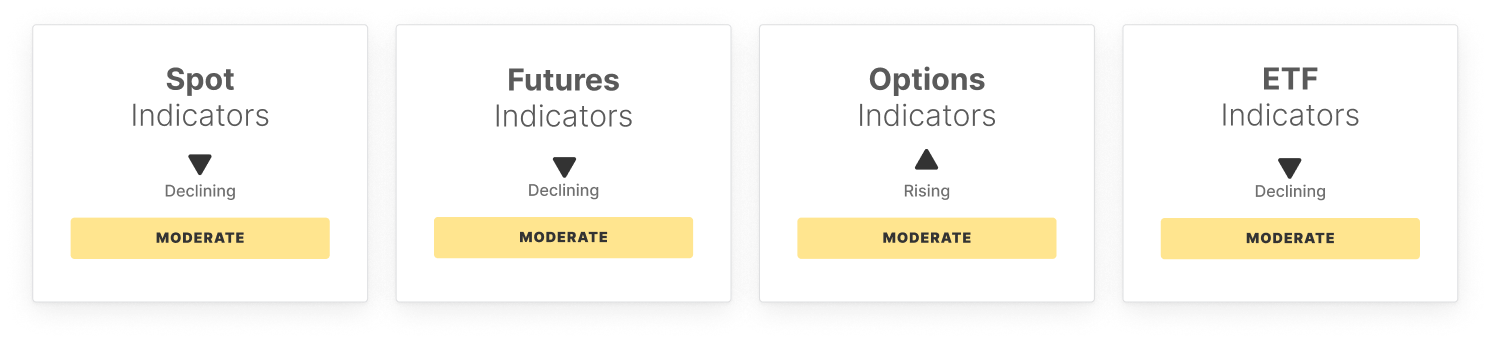

BTC Market Pulse: Week 51

Glassnode·2025/12/15 16:24

Neo Launches MainNet Message Bridge to Boost Next-Gen Cross-Chain Interoperability

BlockchainReporter·2025/12/15 16:21

Bitwise amends Hyperliquid ETF filing, finalizes ticker and fee

The Block·2025/12/15 16:12

![Why Movement [MOVE] crypto is up – L1 shift, buybacks & more!](https://img.bgstatic.com/spider-data/c2f13dd31249100333c4e0f07cfa73bf1765814594488.png)

Why Movement [MOVE] crypto is up – L1 shift, buybacks & more!

BlockBeats·2025/12/15 16:03

Chainlink and XRP Flash Mixed Signals, While Zero Knowledge Proof’s Live Presale Auction Pulls In Traders with Its Fair-Access Model!

BlockchainReporter·2025/12/15 16:00

Flash

00:52

BitMine increased its holdings by 67,886 ETH in the past 24 hoursAccording to monitoring by Lookonchain, Tom Lee's BitMine purchased approximately 67,886 ETH in the past 24 hours, worth about $201 million.

00:51

BitMine has increased its ETH holdings by 67,886 in the past 24 hours, worth $201 millionBlockBeats News, December 24th, according to LookIntoChain monitoring, in the past 24 hours, Tom Lee's BitMine once again bought 67,886 ETH, worth approximately $201 million.

00:49

Analyst: 2025 will be a watershed year for cryptocurrency policy, with regulatory clarity driving institutional adoptionBlockBeats News, December 24, according to crowdfundinsider, Ari Redbord and Angela Ang from the TRM Labs policy team, together with TRM's EMEA compliance advisor Luke Dufour, jointly reviewed the most important matters in global crypto policy for Q4 2025 and examined crypto policy developments in 30 jurisdictions, revealing several key trends: · Stablecoins dominated the policy agenda, with more than 70% of jurisdictions advancing stablecoin regulation in 2025. · Clearer regulation created favorable conditions for institutional adoption, with financial institutions in about 80% of jurisdictions announcing new digital asset initiatives. · The impact of regulation on illicit financing remains evident. TRM analysis found that Virtual Asset Service Providers (VASPs), as the most heavily regulated part of the crypto ecosystem, have a significantly lower rate of illicit activity compared to the overall ecosystem. TRM Labs pointed out that 2025 is a "watershed year for US crypto policy." At the same time, Q4 reinforced the fact that the momentum for crypto policy is "no longer just about bills moving through Congress." Instead, regulators are increasingly "using guidance, supervision, and enforcement to achieve policy objectives."

News