News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.23)|Michael Selig Appointed as the 16th Chair of the CFTC; Powell Has Secured Three Rate Cuts; Strategy Adds $748M to Its Reserves2Bitget US Stock Daily Report | Gold Breaks $4,460; Tesla Approaches $500; Novo Nordisk Oral Drug Approved (December 23, 2025)3Bridgewater founder: Enormous risks from huge bubbles and vast wealth gaps

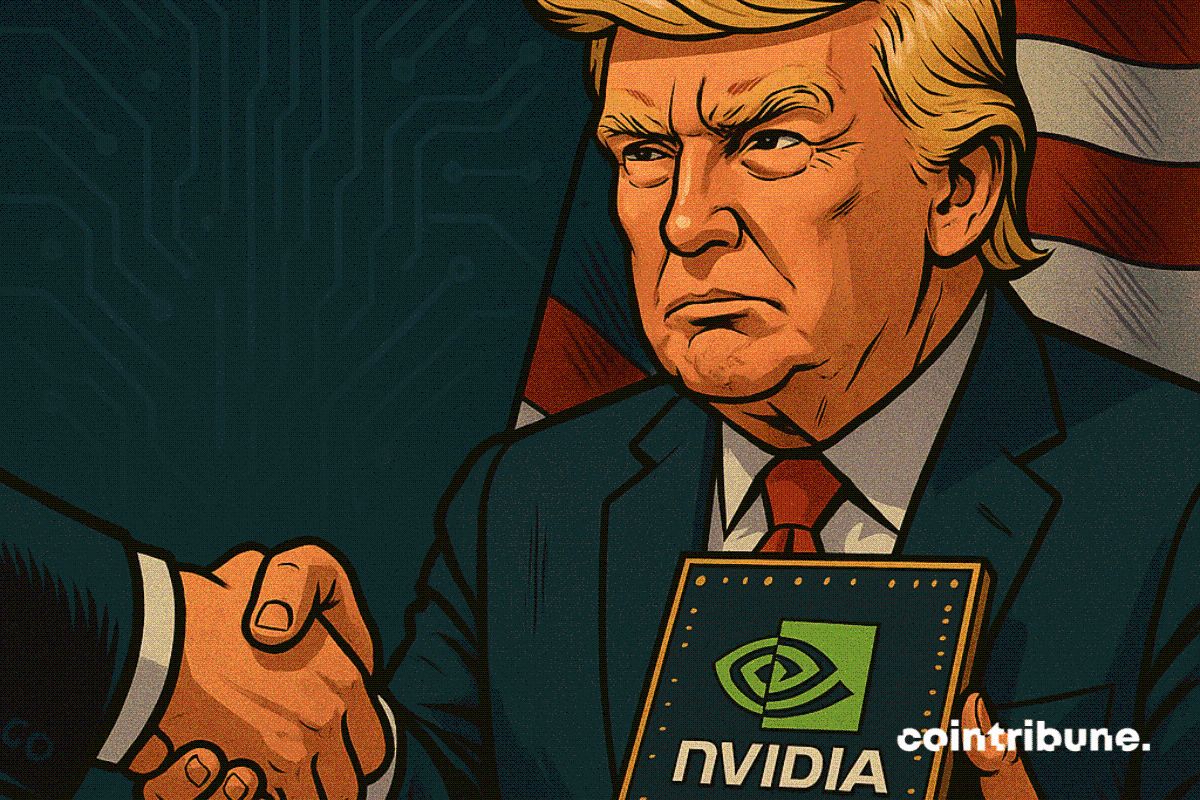

Crypto: Nvidia Courts Trump With a Charm Offensive That Pays Off

Cointribune·2025/12/15 19:36

Sudden Drop Sends Bitcoin Below $87K

Cointribune·2025/12/15 19:36

Circle acquires Axelar development team: A strategic masterstroke for USDC dominance

BitcoinWorld·2025/12/15 19:33

Bitcoin Price Plummets: BTC Falls Below $86,000 in Market Shakeup

BitcoinWorld·2025/12/15 19:33

Bitcoin Parabolic Trendline Broken: Peter Brandt’s Dire Warning for BTC

BitcoinWorld·2025/12/15 19:33

Revealing Truth: SEC Commissioner Declares Public Blockchains the Most Transparent Financial System Ever

BitcoinWorld·2025/12/15 19:33

Aster’s Revolutionary Private Trading Mode: Shield Your Trades with 1001x Leverage

BitcoinWorld·2025/12/15 19:33

Revolutionary: MoonPay Commerce App Launches for Solana Mobile’s Seeker Smartphone

BitcoinWorld·2025/12/15 19:33

MetaMask Bitcoin Support: A Game-Changer for Crypto Wallets

BitcoinWorld·2025/12/15 19:33

UK Moves to Bring Crypto Firms Under Financial Services Law

DeFi Planet·2025/12/15 19:30

Flash

16:29

BitMine-related address buys another 6,678 ETH worth $19.63 millionAccording to ChainCatcher, monitored by Onchain Lens, a BitMine-related address has once again purchased 6,678 ETH from BitGo, valued at 19.63 million US dollars.

16:29

BitMine Increases ETH Holdings Again by 6678 Coins, Worth $19.63 MillionBlockBeats News, December 24th, according to Onchain Lens monitoring, the BitMine affiliated address once again purchased 6678 ETH through BitGo, worth $19.63 million.

16:14

Upexi submits Form S-3 to the SEC to optimize Solana asset managementChainCatcher reported that Upexi, Inc. (NASDAQ: UPXI), which focuses on Solana digital assets, has announced the submission of a Form S-3 registration statement to the SEC. The company plans to cancel its existing equity credit line (which has not been used) after the registration statement becomes effective. Upexi stated that this adjustment will improve the company's fundraising efficiency and reduce overall transaction costs through a more flexible timing and pricing mechanism, thereby supporting its Solana asset management strategy.

News