News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.23)|Michael Selig Appointed as the 16th Chair of the CFTC; Powell Has Secured Three Rate Cuts; Strategy Adds $748M to Its Reserves2Bitget US Stock Daily Report | Gold Breaks $4,460; Tesla Approaches $500; Novo Nordisk Oral Drug Approved (December 23, 2025)3Bridgewater founder: Enormous risks from huge bubbles and vast wealth gaps

Ripple Labs in South Africa? Top Exec Shares Crucial Hint

UToday·2025/12/16 09:30

Dogecoin Jumps 77% in Volume as Crucial Support Gets Tested

UToday·2025/12/16 09:30

'This Is Not Journalism': Ripple CEO Takes Aim at NYT

UToday·2025/12/16 09:30

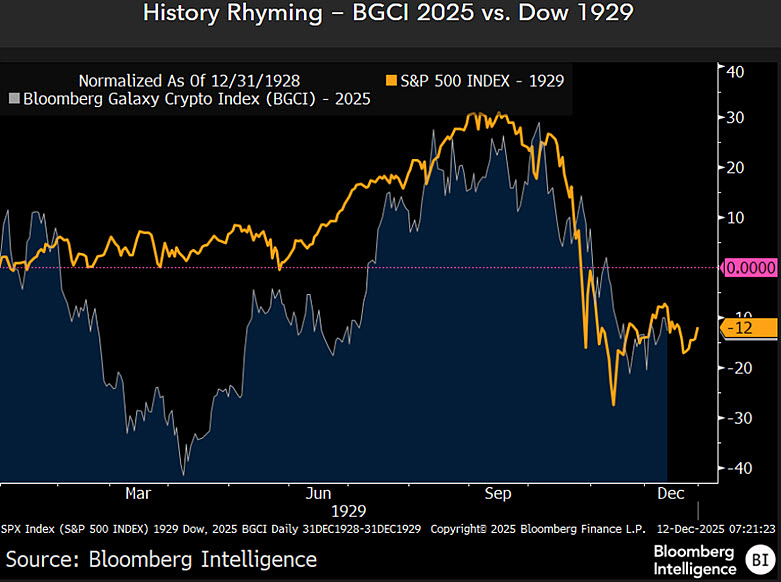

Bitcoin May Be Repeating 1929 Great Depression, Top Bloomberg Strategist Warns

UToday·2025/12/16 09:30

XRP Urgent Alert Issued to Node Operators: Reason

UToday·2025/12/16 09:30

Ripple Announces Major Update to Enhance Utilities for XRP and RLUSD

UToday·2025/12/16 09:30

SEC Chair Warns Crypto May Become Powerful Financial Surveillance Tool

Cryptotale·2025/12/16 09:30

Trust Wallet launches gas-sponsored gas-free Ethereum swap service

币界网·2025/12/16 09:22

Flash

09:24

OpenEden launches yield-bearing stablecoin cUSDO on Solana, fully backed by tokenized US TreasuriesAccording to an official announcement reported by Odaily, OpenEden has launched the yield stablecoin cUSDO on Solana. cUSDO is a wrapped, composable version of USDO, which is a regulated yield stablecoin issued by OpenEden and fully backed by tokenized US Treasuries. Every cUSDO circulating on Solana is fully collateralized by tokenized US Treasuries, which can be verified on-chain and are held by qualified custodians, including BitGo and a certain exchange Prime. Major users can redeem USDO or cUSDO at face value at any time, and user protection is ensured even in the event of issuer bankruptcy. cUSDO creates value for holders through its yield-generating design. The yield is reflected in the continuously increasing price of cUSDO and originates from the reserve of tokenized US Treasuries. Its token design allows it to be fully composable and integrated into lending markets, derivatives, structured products, automated strategies, and other DeFi applications.

09:17

Ostium co-founder: This quarter, commodity trading volume accounted for nearly 40% of total trading volumeForesight News reported that Kaledora, co-founder of the decentralized exchange Ostium, stated in a post that commodity trading volume on Ostium accounted for nearly 40% of total trading volume this quarter. She noted that as gold and silver prices continue to hit record highs and cryptocurrency trading activity remains sluggish, there is a huge market demand for new asset classes that can be traded on-chain.

09:12

Scam Shield: 2 Wallet Addresses Lose 2.3M U Due to Private Key Leak, Attacker Laundered Funds Through TornadoCashBlockBeats News, December 23rd, according to PeckShield monitoring, wallets 0x1209...e9C and 0xaac6...508 have been hacked, resulting in a loss of approximately 2.3 million USDT due to private key exposure. The attacker exchanged the stolen USDT for 757.6 ETH and laundered it through TornadoCash mixing.

News