News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.23)|Michael Selig Appointed as the 16th Chair of the CFTC; Powell Has Secured Three Rate Cuts; Strategy Adds $748M to Its Reserves2Bitget US Stock Daily Report | Gold Breaks $4,460; Tesla Approaches $500; Novo Nordisk Oral Drug Approved (December 23, 2025)3Bridgewater founder: Enormous risks from huge bubbles and vast wealth gaps

CFTC’s Historic Authorization of Spot Crypto Trading Opens New Era

BlockchainReporter·2025/12/16 09:45

Bitcoin to Hit New Highs in 2026, Grayscale’s Bold BTC Prediction

Coinspeaker·2025/12/16 09:42

The New York Times: After Trump Returns to the White House, Major Retreat in US SEC Crypto Lawsuits

BlockBeats·2025/12/16 09:39

With the integration of crypto wallets, MetaMask has added support for Bitcoin.

币界网·2025/12/16 09:39

XRP whales disappear, leaving behind 1.18 billion tokens in 4 weeks

币界网·2025/12/16 09:39

Anchorage Digital Acquires Securitize For Advisors to Expand Crypto Wealth Management

DeFi Planet·2025/12/16 09:33

MoveBit under BitsLab Releases Research|Belobog: A Move Fuzz Testing Framework for Real-World Attacks

TechFlow深潮·2025/12/16 09:31

Flash

11:44

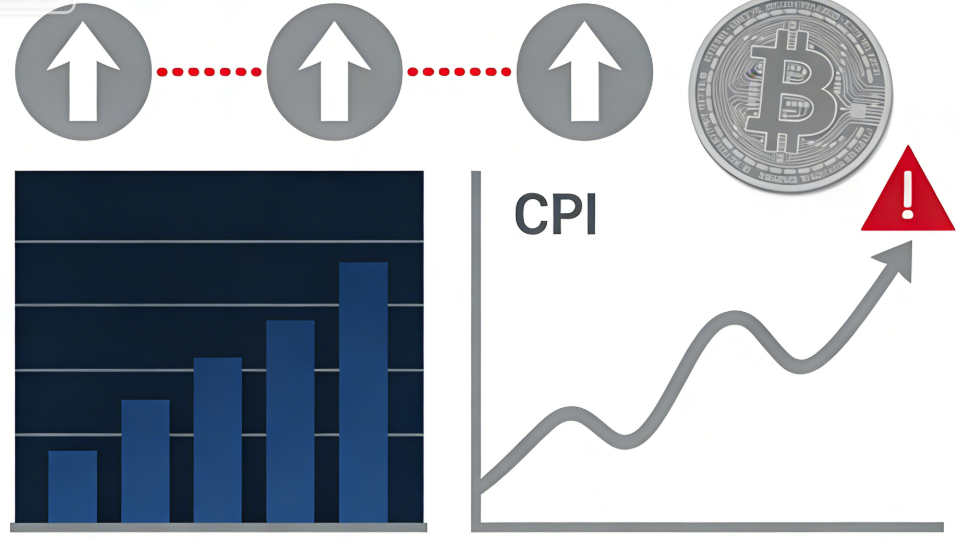

Analysis: Record Options Expiry This Friday to Amplify Market Volatility, BTC and ETH Options Expiry Totaling $28.5 BillionChainCatcher reported that the combination of thin market liquidity during the Christmas holiday, surging precious metal prices siphoning off liquidity, and the upcoming record-breaking options expiration has kept bitcoin below $90,000 today. Analysts warn that the record options expiry this Friday will amplify volatility.

11:44

Ontario Health Care Pension Plan of Canada Buys $13 Million USD of Strive StockBlockBeats News, December 23rd, according to BitcoinTreasuries, the $90 billion Ontario Healthcare Pension Fund has purchased 14.8 million shares of the Bitcoin treasury company Strive (ASST), worth $13 million.

11:39

Hyperscale Data increases its bitcoin treasury allocation to approximately $76 millionBlockBeats news, on December 23, according to PR Newswire, US-listed AI data center company Hyperscale Data announced that it has increased its bitcoin treasury allocation to approximately $76 million. Currently, its wholly-owned subsidiary Sentinum holds a total of 514.9655 bitcoins. In addition, $30.5 million in cash will be allocated to continue increasing its holdings in the open market, with the goal of reaching a total bitcoin treasury value of $100 million.

News