News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

If Cook resigns, it would potentially allow Trump to gain four seats, giving him a majority on the seven-member board.

In history, September has usually been one of the worst-performing months for Bitcoin and Ethereum, known as the "September Curse," having occurred multiple times during bull market cycles.

Pantera’s $1.25 billion Solana treasury push has failed to spark gains as SOL slides nearly 10%. Weak futures demand and bearish signals point to further downside risks.

Bitcoin faces a potential correction. It must quickly reclaim $110,800. Failure to do so could trigger a further downturn. Glassnode identified a key metric. $110,800 is the average cost for new investors, based on May through July buyers. During this period, Bitcoin hit new all-time highs. Bitcoin Should Defend $110,800 Glassnode explains that the average … <a href="https://beincrypto.com/110800-bitcoins-new-key-defense-line-glassnode/">Continued</a>

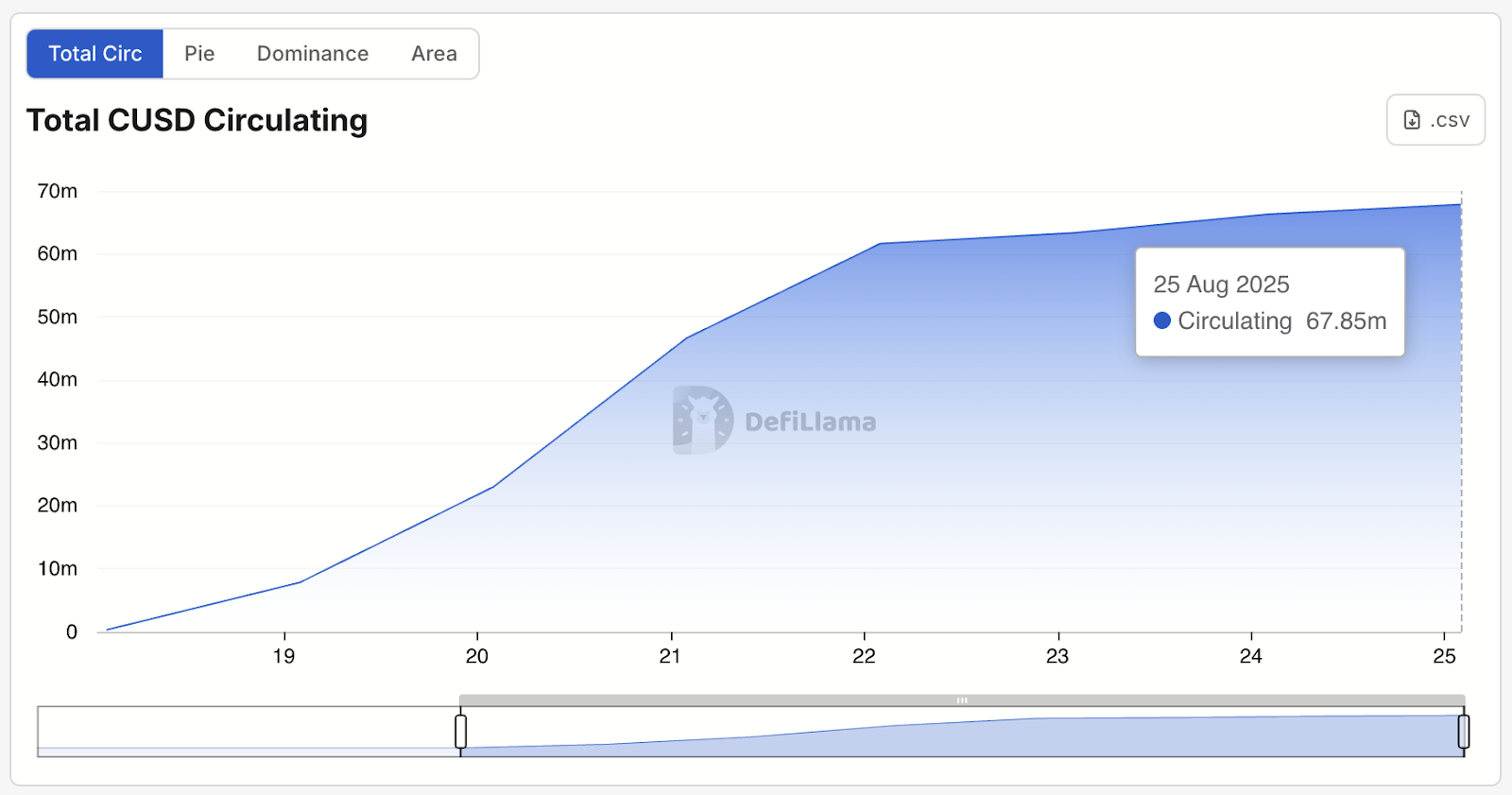

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

Bitcoin’s $110,000 support is under pressure as futures and spot traders lean bearish. Without renewed demand, BTC risks sliding to $107,557.

- 09:55BNY Mellon: The Fed Will Deliver a Hawkish Rate Cut This Week, Dot Plot Reveals Policy DivergenceAccording to ChainCatcher, citing Golden Ten Data, analysts at Bank of New York Mellon stated in a report that the market has fully priced in expectations for a Federal Reserve rate cut this month. However, there is a growing consensus that this will be a hawkish rate cut, and further monetary easing will depend on whether economic data released in March and June 2026 weakens or if inflation continues to decline. The analysts also mentioned that the upcoming change in the Federal Reserve chair poses a risk, as the market will assess the policy inclinations of the new leadership. In addition, the FOMC will release a dot plot, and it is expected that there will be significant divergence among committee members regarding the policy direction for 2026, reflecting two-sided economic risks.

- 09:28Cryptocurrency-related stocks rose broadly in U.S. pre-market trading, with BMNR up 4.55%.Before the US stock market opened, cryptocurrency-related stocks generally rose, including: · MSTR up 2.58%; · a certain exchange up 2.13%; · HOOD up 1.75%; · SBET up 3.26%; · BMNR up 4.55%; · CRCL up 2.20%.

- 09:24Asset management firm: US stock market is overvalued, maintain a cautious stanceAccording to ChainCatcher, citing Golden Ten Data, analysts at the French asset management company Edmond de Rothschild Asset Management stated in a report that the US stock market is overvalued and should be approached with caution. The analysts pointed out that the recent upward trend in the stock market relies on the Federal Reserve cutting interest rates in this week's rate decision. However, internal voting disagreements and differing opinions among committee members may weaken market expectations for three rate cuts in 2026. Currently, the US money market estimates an 86% probability of a 25 basis point rate cut this week.