News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Most projects are still finding their footing. But those that have gotten it right—projects with revenue, strategy, and trust—have the opportunity to become the much-needed "cathedrals" of the industry, providing a long-term, stable benchmark.

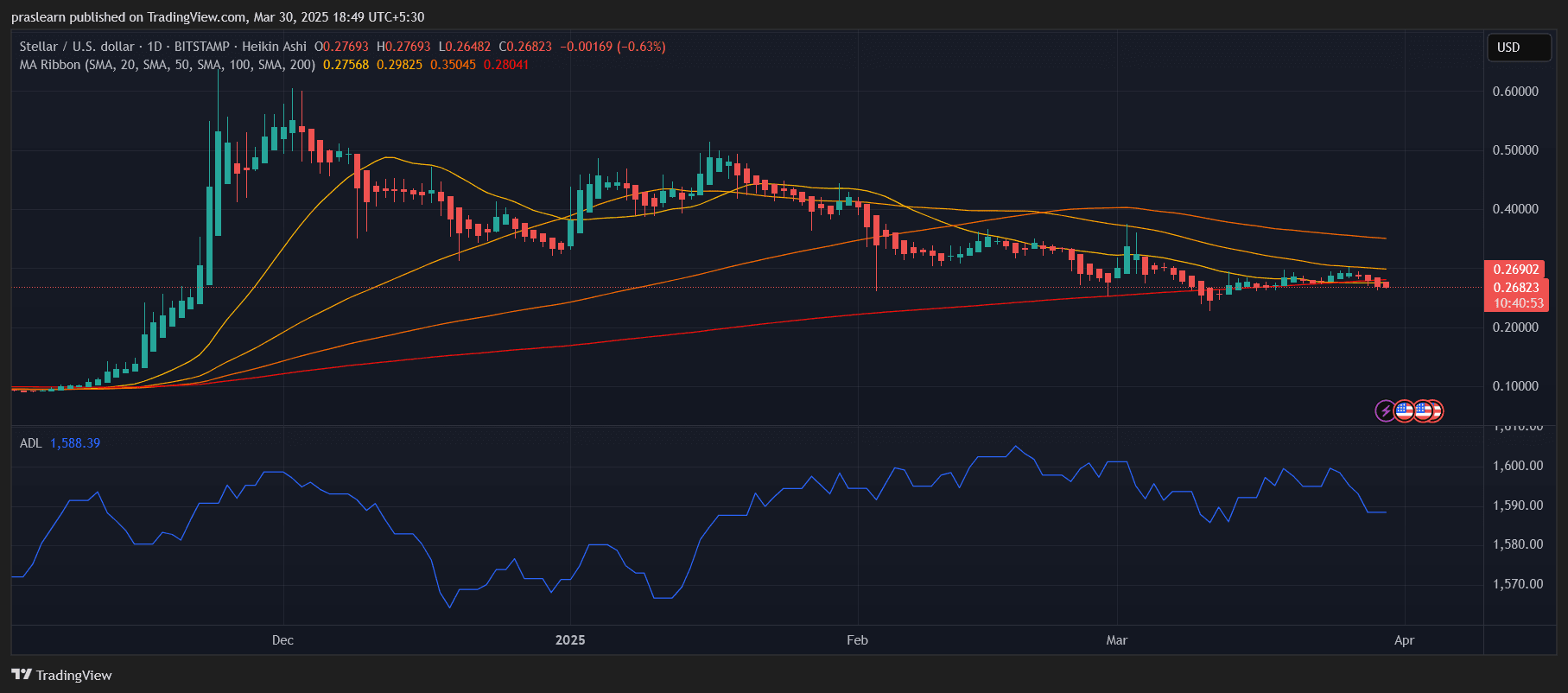

Crypto markets show cautious optimism as altcoins end a five-week streak of outflows, with analysts predicting a potential recovery and rally in the near future.

Crypto markets face a week of high stakes, with potential tariffs, network upgrades, and token unlocks creating both risks and opportunities for traders.

Bitcoin struggles near $80,000 with the looming potential of a Death Cross, as investor sentiment weakens and losses grow. A drop below $80,000could trigger further declines.

- 11:26Data: 222 million USDT transferred to major exchanges in the past hourAccording to ChainCatcher, data from Coinglass shows that a total of 222 million USDT has been transferred into major exchanges in the past hour.

- 11:03PeckShield: Credix Suffers Attack with Losses of Approximately $4.5 MillionAccording to ChainCatcher, security monitoring by PeckShield has revealed that CrediX suffered a security breach today, with hackers exploiting a compromised administrator account that held multiple management permissions. This account had the following privileges: POOL_ADMIN (pool administrator), BRIDGE (cross-chain bridge access), ASSET_LISTING_ADMIN (asset listing administrator), EMERGENCY_ADMIN (emergency administrator), and RISK_ADMIN (risk control administrator). The attacker leveraged the BRIDGE privilege to steal or borrow assets from the pool, with estimated losses of approximately $4.5 million. The incident also involved the minting of counterfeit acUSDC tokens (Credix Market Sonic USDC) that were not backed by real assets. Previous reports indicated that CrediX has already taken its website offline and suspended user deposits. Users who need to take action are advised to withdraw via smart contract.

- 10:37CFTC Launches "Crypto Sprint" Initiative to Accelerate Advancement of the Trump Administration's Crypto Asset Regulatory RoadmapAccording to ChainCatcher, as reported by The Block, the U.S. Commodity Futures Trading Commission (CFTC) today announced the launch of a special initiative called "Crypto Sprint," aimed at rapidly implementing the policy recommendations released last week by President Trump's Digital Asset Markets Working Group. CFTC Acting Chair Caroline Pham stated that the agency will work closely with the SEC to jointly advance the on-chain transformation of the U.S. financial system, realizing the Trump administration's vision of "making the United States the global capital of cryptocurrency." This initiative is based on the Trump Working Group's comprehensive 168-page report, with key focuses including clarifying individuals' rights to self-custody of cryptocurrencies, regulating the scope of banks' crypto-related activities, and granting the CFTC regulatory authority over spot markets for commodity-type crypto assets. The plan is coordinated with the SEC's "Project Crypto," marking a new phase in U.S. crypto regulation as it shifts from ambiguous restrictions to proactive institution-building.